All Categories

Featured

Table of Contents

It is essential to note that your money is not directly spent in the stock exchange. You can take cash from your IUL anytime, but charges and give up fees might be connected with doing so. If you need to access the funds in your IUL plan, considering the pros and cons of a withdrawal or a loan is essential.

Unlike direct investments in the supply market, your money worth is not straight purchased the hidden index. Rather, the insurer utilizes economic tools like choices to link your cash money value development to the index's performance. Among the unique attributes of IUL is the cap and floor rates.

What is included in Iul Growth Strategy coverage?

The fatality advantage can be a set quantity or can include the money worth, depending on the plan's framework. The cash value in an IUL policy grows on a tax-deferred basis.

Always review the plan's details and seek advice from with an insurance policy specialist to completely comprehend the advantages, restrictions, and prices. An Indexed Universal Life insurance policy policy (IUL) offers an one-of-a-kind blend of functions that can make it an eye-catching choice for certain individuals. Below are some of the vital benefits:: Among the most appealing facets of IUL is the capacity for higher returns contrasted to various other types of permanent life insurance policy.

What happens if I don’t have Indexed Universal Life For Retirement Income?

Taking out or taking a loan from your plan may decrease its cash money worth, survivor benefit, and have tax obligation implications.: For those interested in heritage preparation, IUL can be structured to supply a tax-efficient means to pass wide range to the following generation. The survivor benefit can cover estate tax obligations, and the cash money worth can be an extra inheritance.

While Indexed Universal Life Insurance Policy (IUL) provides a series of advantages, it's necessary to take into consideration the potential drawbacks to make a notified choice. Here are several of the crucial disadvantages: IUL policies are much more intricate than typical term life insurance coverage plans or entire life insurance policy plans. Recognizing exactly how the money worth is connected to a stock exchange index and the effects of cap and flooring prices can be testing for the ordinary consumer.

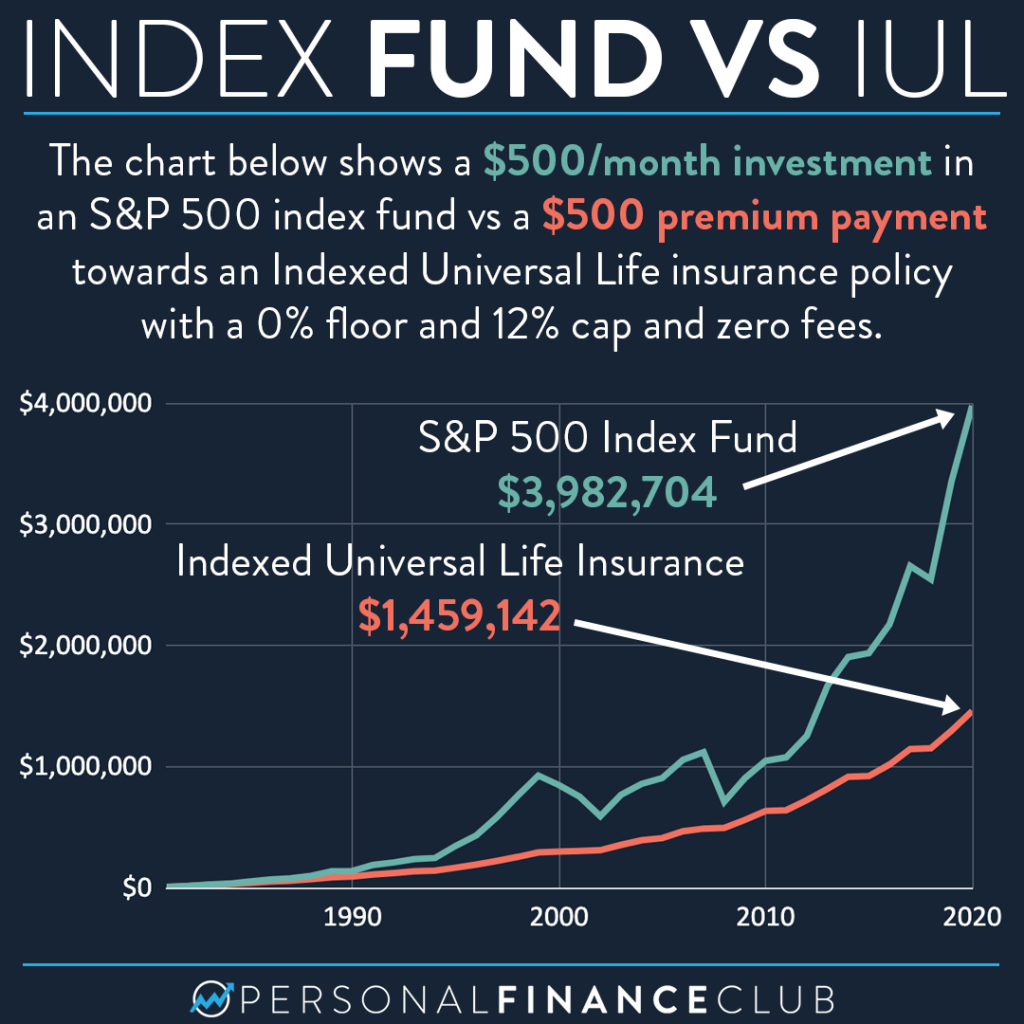

The premiums cover not just the price of the insurance however additionally administrative charges and the financial investment part, making it a pricier choice. Indexed Universal Life loan options. While the money worth has the capacity for growth based on a supply market index, that development is commonly covered. If the index performs remarkably well in a given year, your gains will be limited to the cap rate specified in your plan

: Adding optional features or cyclists can raise the cost.: Exactly how the plan is structured, consisting of exactly how the cash money worth is allocated, can additionally impact the cost.: Various insurer have various rates versions, so looking around is wise.: These are charges for managing the policy and are typically subtracted from the cash value.

What types of Iul Retirement Planning are available?

: The prices can be similar, yet IUL provides a floor to help shield versus market declines, which variable life insurance plans generally do not. It isn't easy to supply a precise expense without a certain quote, as costs can differ considerably in between insurance policy companies and individual scenarios. It's important to stabilize the importance of life insurance coverage and the demand for added security it offers with potentially greater premiums.

They can aid you recognize the expenses and whether an IUL policy straightens with your monetary goals and demands. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and depends on your monetary goals, threat tolerance, and long-term preparation needs. Here are some indicate take into consideration:: If you're looking for a lasting financial investment lorry that offers a survivor benefit, IUL can be an excellent option.

1 Your plan's money value have to suffice to cover your monthly fees - Indexed Universal Life. Indexed global life insurance policy as used right here refers to policies that have not been registered with U.S Stocks and Exchange Compensation. 2 Under current government tax obligation rules, you may access your cash money abandonment value by taking federal revenue tax-free lendings or withdrawals from a life insurance policy plan that is not a Customized Endowment Agreement (MEC) of up to your basis (total costs paid) in the policy

How do I cancel Iul Loan Options?

If the plan lapses, is given up or comes to be a MEC, the financing equilibrium at the time would usually be considered as a circulation and for that reason taxed under the general rules for circulation of plan cash money worths. This is an extremely basic summary of the BrightLife Grow item. For costs and more total information, please contact your monetary specialist.

While IUL insurance policy might show useful to some, it's essential to comprehend exactly how it works before purchasing a policy. Indexed global life (IUL) insurance policy plans supply greater upside prospective, flexibility, and tax-free gains.

What happens if I don’t have Guaranteed Iul?

As the index moves up or down, so does the price of return on the cash value element of your policy. The insurance coverage firm that releases the plan might offer a minimal guaranteed price of return.

Economists often encourage living insurance protection that's comparable to 10 to 15 times your annual income. There are several disadvantages associated with IUL insurance coverage that movie critics are fast to aim out. Someone that establishes the plan over a time when the market is carrying out improperly can finish up with high costs payments that don't contribute at all to the cash value.

Apart from that, remember the following other considerations: Insurance provider can establish engagement prices for just how much of the index return you get yearly. For instance, let's claim the policy has a 70% involvement rate. If the index grows by 10%, your cash value return would certainly be just 7% (10% x 70%).

Is there a budget-friendly Iul Account Value option?

Furthermore, returns on equity indexes are often covered at a maximum quantity. A plan may say your optimum return is 10% each year, regardless of just how well the index does. These restrictions can restrict the real price of return that's attributed towards your account each year, no matter of exactly how well the policy's hidden index performs.

IUL policies, on the various other hand, offer returns based on an index and have variable costs over time.

Latest Posts

Equity Indexed Insurance

Nationwide Single Premium Ul

Index Universal Life Insurance Policy